The spike in financial trading brokerage companies has made it difficult for an investor to locate the righteous broker, and now it requires the trader more than just a simple search.

A deeper dive into details is required now, and this is what we have done to inspect the broker Arum trade to help you make your mind about investing your money with this broker.

In this Arum trade broker review, we have researched the legitimacy of this broker, how real are the offered services and everything you need to know beforehand.

Arum trade is a broker located in Vanuatu and is registered in the Vanuatu Financial Services Commission, which raises the first red flag that concerns every trader.

The broker offers a few bonuses and promotions to lure traders to use the offered moderate maximum leverage of 1:200, besides a floating spread starting from 0 pips as the website indicates.

There are several tradable assets based on the information provided on the website, and they are limited to the Forex market, and very few selected assets from the other markets.

Is Arumtrade regulated?

Arum trade is not regulated by any high-end license that guarantees the rights of the traders, it is rather licensed by one of the lowest forms of licenses, that is the Vanuatu Financial Services Commission.

The reason the VFSC is not a top-notch license is the relaxed regulatory environment surrounding the rules. There are no strict regulations that guideline the behavior of companies there, and no penalizing system that deters operators from illicit activities.

| Broker | Bonus | More |

|---|---|---|

|

Check Website | Review |

This fact has attracted many businesses to offshore their operations to these remote islands, taking advantage of the easy business requirements, the absence of stringent rules, and the cover of the license.

Tradable assets

Disappointingly, there are only a few markets available as Arumtrade broker offers 42 currency pairs, 5 indices CFDs, 5 commodities, and 2 cryptocurrencies. Traders do not have the diverse opportunities that are available with most brokers.

Forex

Arum trade focuses mainly on the currencies market, where 42 currency pairs are available for traders, with floating spreads.

The major currencies such as EUR/USD, USD/JPY, USD/CHF, GBP/USD, and AUD/USD can be found on the platform besides very few crosses and exotics.

Indices

There are 5 indices CFDs that can be found for trading with Arumtrade – they include US corporations indices, besides the Japanese, French and Australian indices.

Commodities

This is another market with a limited amount of products available by this broker, as commodities trading includes only energy and 1 metal asset with variable spread ranges.

These commodities are mainly Gold against major currencies, silver against the USD, and the only energy asset Brent Crude oil.

Cryptocurrencies

Trading cryptos is something that Arum trade financial broker is definitely not proud of, there are only 2 cryptos that can be found, the Bitcoin and the Litecoin against the USD.

This market is one of the most growing markets that excites every trader nowadays, and this broker is missing out a lot by this very limited offering of access on this market.

Trading Platforms

Another limitation found on this broker website is the trading platforms, many traders prefer having multiple tools and platforms to open market positions including Webtraders and external software.

Arum trade MT5 trading platform is the only way for traders to access any market offered on the website, which is, in fact, one of the most used platforms used by traders around the world.

Arumtrade intends to showcase a reliable image by adopting this popular platform, but at the same time, it is very easy to get an affiliate link which the broker is providing here.

Also, some traders prefer using the Webtrader which enables users to manage their market positions using a web-based platform, which can be directly accessible on the website without the installation of a 3rd party software.

Creating your account

Once you have decided to move for the registration process, you will need to find the orange box on the top right content and hit “login”, then find “register”

You will need to enter your personal information including your name, email address, and phone number, and then check the boxes that you agree on the terms and conditions and the privacy policy.

After that you will be asked a few questions before finalizing the registration process. You will encounter a questionnaire that will ask you about your experience and your expectations from trading, which will help the trader know more about you.

You will be asked to submit identification documents and credit card details, but since Arumtrade is a scam broker, you need to be aware that the information you will deliver is probably not in safe hands.

Live trading account

Unlike most financial brokers, there is only one account type offered by Arumtrade, called ECN.Trade.real account. Which allows users to trade using 0.01 lot size at least.

The currency used on this account is the USD, the deposit fee is 0%, while the floating spread range is said to be starting from 0 pips.

The minimum deposit required once signed up is $1, as well as some commissions and charges related to trading activities in this account, and overnight swap fees.

It can become confusing because on this account type the tradable assets are mentioned differently in comparison to the “instruments” tab.

In this account details, it is mentioned that shares trading is available with 1:5 max leverage, and more assets are available on every other market, which contradicts what is said elsewhere on the website.

It is a characteristic of scam brokers, which makes us realize that Arum trade broker is a fraud, since they do not pay attention to the information mentioned on the website, and each section mentions something different.

Commissions & fees

There are several charges associated with the live trading account, and they are between trading and non-trading activities, which we will explain as the following:

CFD trading commissions

Trading charges are regarding two types of instruments only. Firstly, The CFD trading on shares, where there are two charges, a fixed $6 per trade, as well as 0.06% commissions of the volume traded.

Arum trade financial broker charges commissions while trading cryptos, where traders who trade Bitcoin or Litecoin are to pay $3 per trade, and 0.15% from the volume used for trading.

On the other hand, there are no commissions charged when trading currencies, or CFDs of indices and commodities.

Rollover fees

It is only allowed for trading shares CFD to keep the trading position running overnight, however, that is not done for free.

The broker charges a percentage of the opening price, and the specific percentage is disclosed only when the trader intends to keep the account running over the next day.

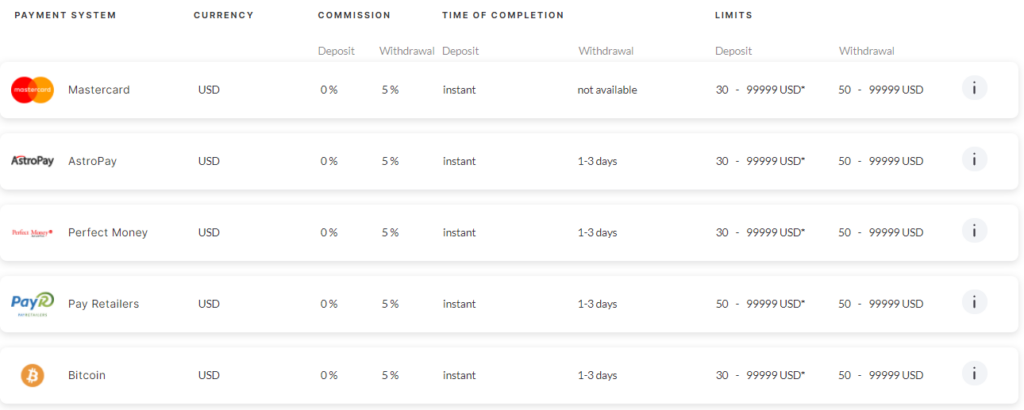

Payment methods

Neteller and Skrill are famous e-wallets payment methods and www.arumtrade.com used to adopt these two methods, but not anymore since Skrill & Neteller became stricter against suspicious transactions to fight money laundering, which does not suit Arum trade operations.

Deposits

Mastercard is the main method while funding your trading account with Arum trade broker, besides some e-wallets options such as AstroPay, Perfect Money, Pay Retailers.

At the same time, crypto wallets are also allowed for traders to fund their accounts and are usually a faster funding method.

These depositing methods have 0% commission fees, are instantly processed, and need at least a $30 minimum deposit. Except for the Pay Retailed method that required $50 at least.

Withdrawals

Surprisingly, Mastercard withdrawals are not allowed, and that is surprising because it is the most common method, and reliable brokers usually allow the same method to be used for depositing and withdrawing money.

Other than that, all other depositing methods can be used for cashing out, but the minimum amount must be $50 at least.

The commission on all withdrawal methods is 5%, and it is usually processed within 3 days.

Bonuses

One of the classic ways to attract as many people as possible to register their account is by incorporating promotions and bonuses, which is the same case for this broker.

First deposit bonus

Once the live account is verified, any user can use this Arum trade welcome bonus offer and receive $30 once the first deposit is done.

However, the website states that the minimum deposit amount can be indicated by the company at a current time, which raises some risks that the required amount could be different from what a trader is expecting.

The Arum trade bonus of $30 can be used for trading on any instruments offered by the broker, however, it is not mentioned what cases can a trade withdraw using this bonus, and the lack of information leaves mane traders confused.

Special features

There are some additional properties that a trader can benefit from while trading on Arumtrade, such as the VIP program and PAMM investment funds.

VIP program

A trader can be eligible for the VIP program once they keep a balance of $30,000 at least, and with active trades for the last two years.

The Arumtrade financial broker VIP program gives the trader the privilege of having a personal manager, withdrawing money without commission, and free VPS.

However, it is not suggested to deposit such a huge capital at the hand of this broker because the traders are likely to get scammed.

Investment funds

There are some options for traders who are seeking investment opportunities outside classic financial markets, by investing in PAMM style funds, where a fund is run by a fund manager, and wealthy investors deposit huge streams of money.

However, this feature seems very sketchy because the website indicates many unknown funds’ names that are offered, and this is another way to scam more investors and steal more money.

The offered investment funds are visualized with charts and signals but that validity cannot be checked and is more likely to be totally fraudulent activity.

Affiliate program

Partnership programs are usually offered by many brokers, and this broker offers a 3-tier type of affiliate program where one can register and use an affiliate link to bring more clients to Arum trade brokers.

This program offers affiliates to receive up to $12 per traded lot, however, details are not known until an affiliate is registered.

Research tools

The website enables users to have a heads-up regarding market activity and to have an idea about what is being done with their money, and to learn more about trading opportunities.

Market news

One way to look legit is to keep the traders informed about trading news, by offering market review and analysis, however this function of Arum trade broker’s market reviews is obsolete and outdated, the last market review was done 6 months ago.

Signals & Indicators

This section shows traders the tendency about every tradable asset, by showing what is the sentiment now to buy or to sell, and how strong is that.

However, this page is also not very useful at the moment because the last update on the page was 5 months before writing this review, which uncovers one of the many Arum trade broker website flaws regarding the consistency of information.

Education

This section of the website includes some basic information for the beginner to learn more about trading and the terminologies used, to be more informed, and to be aware of managing their capital.

The video content provided here is very fundamental and does not really add to the advanced trader, since there are a handful of videos, and the information is very primitive.

Customer service

The website is developed in several languages to attract traders who speak different languages such as Russian, Spanish, Portuguese, Vietnamese as well as the English language.

However, the only other language the support team speaks is Spanish.

The lack of a live chat feature makes users believe that Arum trade cannot be trusted because there is no support shown for traders who invest thousands of dollars to fund their accounts hoping to generate money.

There is a telephone number disclosed to call the broker if the trader faces any issues, but this does not really help the traders, because the call can go for almost an hour without anybody picking up on the other side.

Verdict

After investigating all the services offered, and considering all the Arumtrade broker opinions on the scam activity being reported, we do not recommend getting your hands with this broker.

On the surface, it shows that the broker holds a license, however, this is the lowest tier of licenses and it opens the door for brokers to practice their sketchy activities without being punished by any authority.

The confusion regarding the information provided on the website makes us believe that Arum trade is a fraud, and they pay attention to scamming activities more than paying attention to the quality being provided in their services.